There's obviously been a lot of writing about the financial crisis as it's unfolded, and I've managed to resist the urge to post anything too close to it to date. Well, no longer.

It's been a fairly busy year for me, what with the house buying and associated poverty, the new job and the crazy hair loss. It made me think about how different this year could have been.

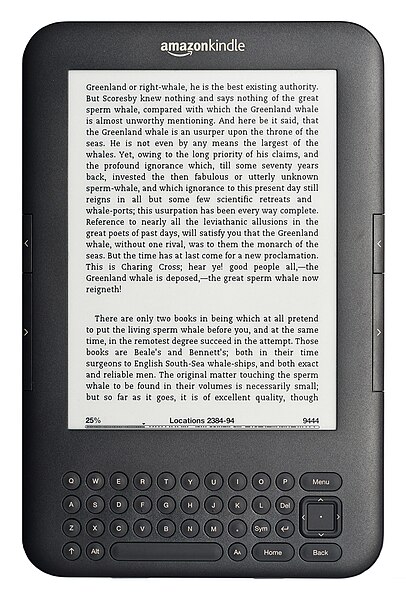

Could I could have taken redundancy? Then I'd have had a payout, some time off, re-entered a pretty good job market (for what I did) and possibly still have my hair. I'd probably be a little more poverty stricken, but I'd still have a house. I'd have spent some time in it. Instead, I opted for long hours and some seriously bad days, and now, with three months till my bonus (which was not meant to be joy inducing this year), I have this .

There are so many things wrong with that new tax. The threshold is ridiculous. I think it's highly unlikely that only 20,000 people in the UK who work in "banks and building societies, including groups that operate in the UK under a European Union branch system" have a bonus of more than £25,000. It seems feasible that 5,000 earn more than a million but there are a lot of VPs and above in banking, if you include the middle and back offices, who would probably meet the threshold in a semi-decent year. So what if it's the bank that pays? It's the people on the ground who worked. With five months prior to the end of the tax year this is looking at a cost that no bank would have provided for, which means one of a few things:

- a reduction of the bonus pool in 2009;

- a reduction in the pnl for 2010 via an exceptional item, which I suspect may not be permissible under IFRS but can't remember;

- a reduction in dividends, unlikely for the non-UK banks;

- a reduction in retained earnings.

If the government wanted to penalise excess, they should have taxed the genuinely high bonuses. Ultimately a person with a £25,000 bonus was only going to take home about £15,000. If you are the breadwinner in your family with a stay at home spouse (given the cost of childcare they would have to earn about £8,000 gross annually to breakeven, assuming there is only childcare to consider and not "sunk" costs like clothing, feeding, caring and entertaining. The average salary nationwide for full time workers was £31,323 in 2008 with part timers on £26,020. The top ten percent earn £44,881 and the top five percent £58,917. Given that the bonus data would be built into those numbers, I think it could be tougher than it initially looks).

Don't get me wrong, I appreciate the need for a progressive tax system, and I realise how lucky I am to be able to live the life I do and have a job I enjoy. I just never understand how there is never any consideration of regional variances and household income in the tax system. I guess it's a good thing all the jobs are moving out of the UK, since it seems increasingly like working here is less rewarding and even less supported. When I wake up at 0530 to kick off my day, I do think to myself that every day I work, I pay enough tax to cover three people on unemployment. I don't find that much of an incentive. Particularly since working much less might entitle me to a range of benefits and assitance (childcare, housing, tax breaks anyone?) if I was a National. The injustice is galling, especially when I think about how few of the people I work with are Nationals and therefore entitled to the benefits their taxes help pay for.

BAH. I think I'm officially old and right wing, I know I sound it.

***

Update: These are probably one of the best reflections of sentiment I've seen.

Thursday, December 10, 2009

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment